Equity-Indexed Annuities (EIAs): A Comprehensive Guide

Which of the following are equity-indexed annuities typically invested in – Equity-indexed annuities (EIAs) offer a unique blend of fixed income security and equity market participation. They provide a guaranteed minimum return while offering the potential for higher returns based on the performance of a linked equity index. Understanding the intricacies of EIAs is crucial for investors seeking to leverage their potential benefits while mitigating inherent risks.

Understanding Equity-Indexed Annuities (EIAs)

EIAs are insurance products that combine the safety of a fixed annuity with the potential growth of a stock market index. The contract guarantees a minimum interest rate, typically a low fixed rate, while offering the chance to earn a higher return based on the performance of a chosen index, such as the S&P 500. The actual return is often a percentage of the index’s growth (participation rate), capped at a maximum percentage (cap rate).

Types of EIAs

Several types of EIAs exist, each with variations in how they participate in market gains and manage risk. Common types include:

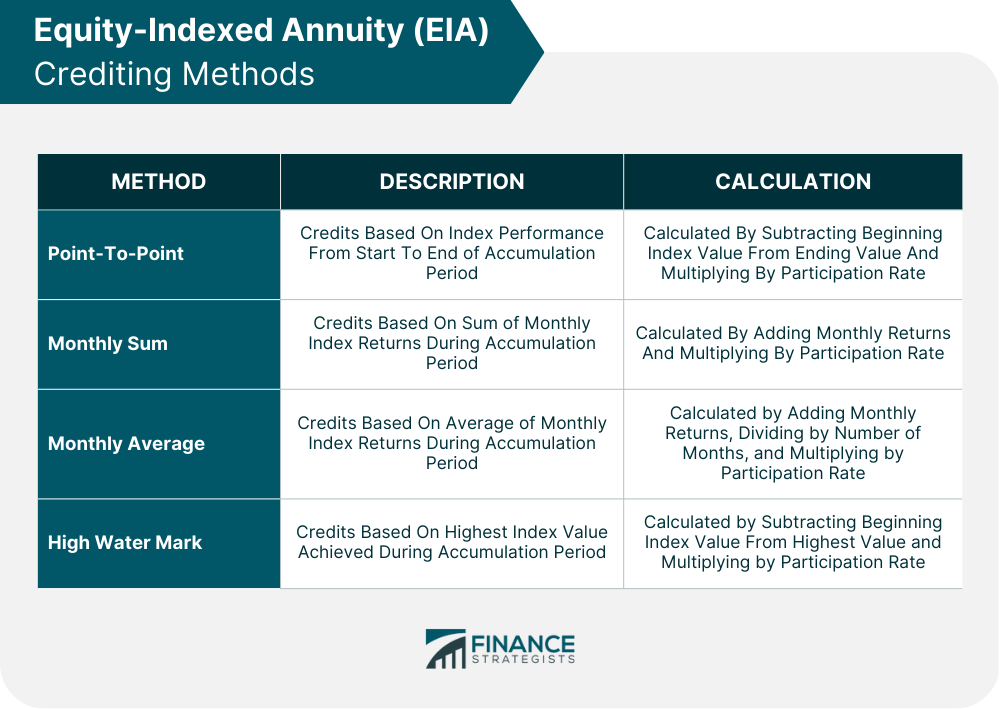

- Point-to-Point EIAs: Return is based on the index’s performance over a specific period (e.g., one year).

- Annual Reset EIAs: The index’s performance is measured annually, with the gains or losses reset each year.

- High-Water Mark EIAs: The highest index value achieved during the contract period is used to calculate the return.

EIAs vs. Traditional Annuities

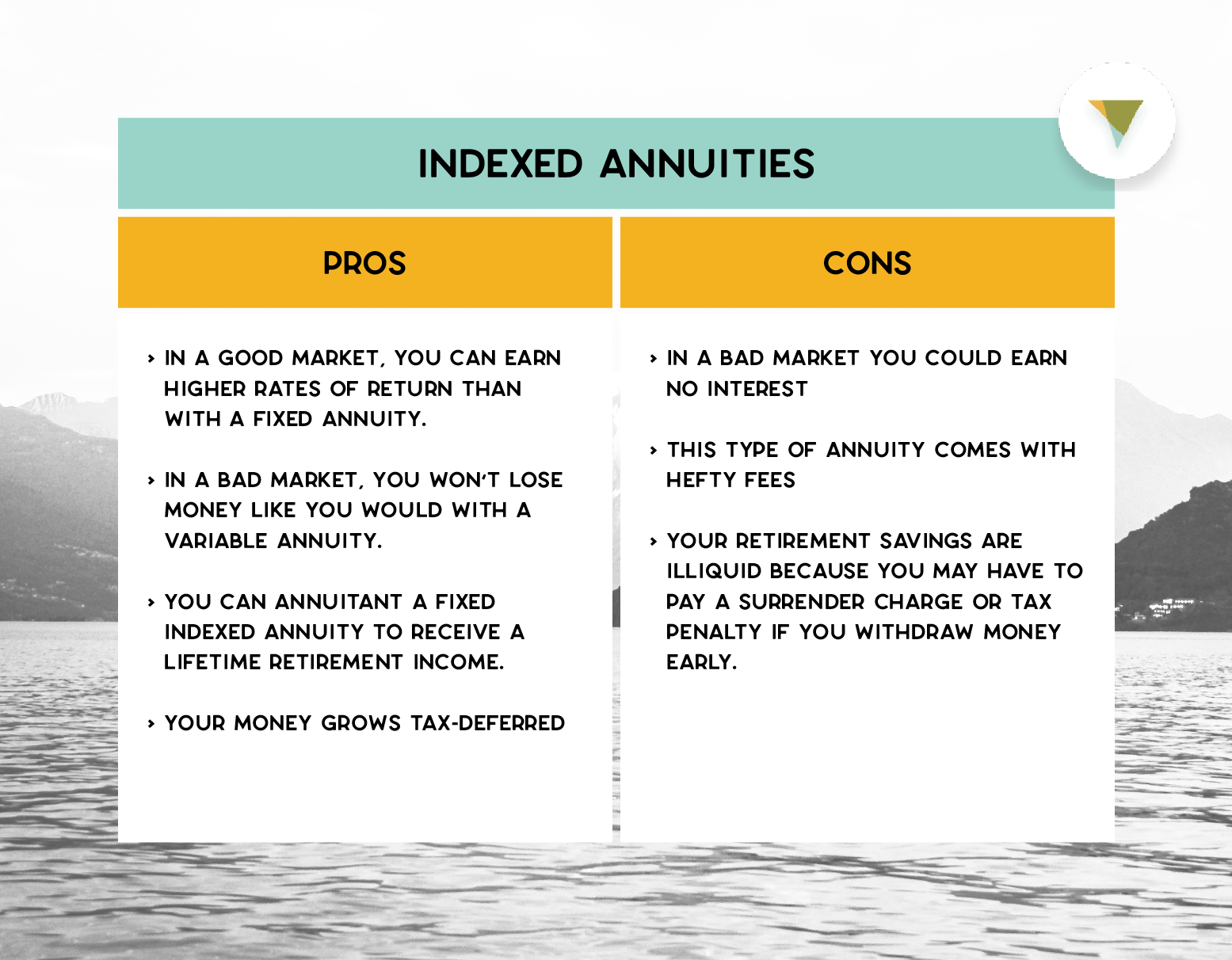

Traditional fixed annuities offer a fixed interest rate, providing predictable returns but limited growth potential. Variable annuities, on the other hand, invest in mutual funds, exposing the investor to market fluctuations. EIAs aim to bridge this gap, providing a degree of market participation while offering a minimum guaranteed return.

| Feature | Fixed Annuity | Variable Annuity | Equity-Indexed Annuity |

|---|---|---|---|

| Return | Fixed interest rate | Variable, based on underlying investments | Guaranteed minimum + potential market participation |

| Risk | Low | High | Moderate |

| Growth Potential | Low | High | Moderate |

Investment Strategies within EIAs

Understanding the underlying index, participation rates, and cap rates is vital for formulating an effective EIA investment strategy. The insurer’s role in managing the investment is also a key factor.

Common Underlying Indices

EIAs commonly use broad market indices like the S&P 500 or sector-specific indices as benchmarks. The choice of index significantly impacts the potential return.

Participation and Cap Rates

Participation rates determine the percentage of the index’s growth credited to the annuity. For example, a 70% participation rate means the annuity will receive 70% of the index’s gains. Cap rates limit the maximum return, protecting the insurer from extreme market growth.

Example: If the index increases by 10%, with a 70% participation rate and a 9% cap rate, the EIA’s return would be 7% (70% of 10%). If the index increases by 15%, the return would still be capped at 9%.

Insurer’s Role in Management

The insurance company manages the underlying investments and guarantees the minimum return. They are responsible for calculating the final credited interest based on the index performance and the contract’s terms.

Hypothetical EIA Investment Strategy

A hypothetical strategy using the S&P 500 index might involve selecting an EIA with a 75% participation rate and a 12% cap rate. This strategy balances potential growth with risk mitigation.

Asset Allocation in EIAs

While the primary investment focus is on the linked index, understanding the broader asset allocation within the EIA portfolio is important. This helps to assess the overall risk profile.

Typical Asset Classes

EIAs primarily invest in assets that aim to track the chosen index. However, the insurer’s underlying portfolio might include a mix of bonds and other assets to manage risk and meet guarantee obligations.

Risk Associated with Underlying Investments

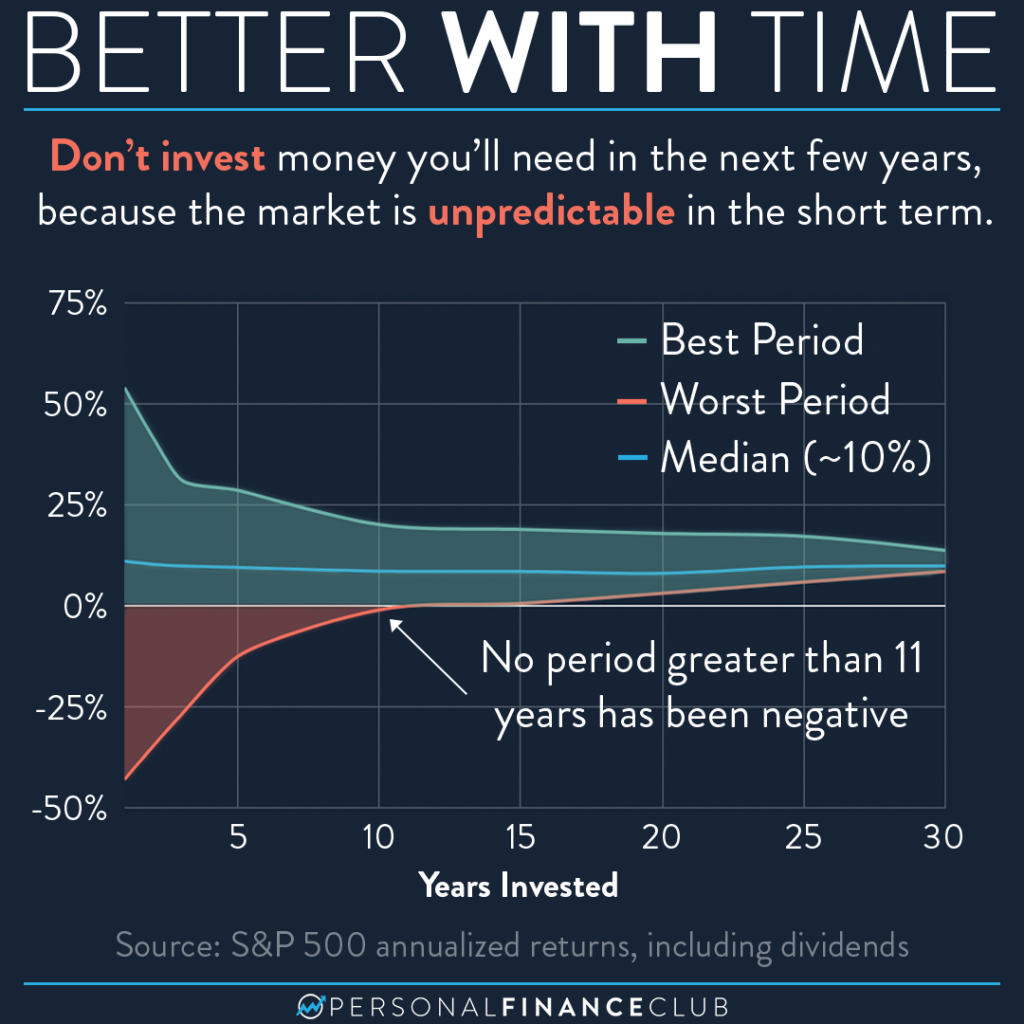

The risk level depends on the chosen index and the participation/cap rate structure. Investing in a broad market index like the S&P 500 carries moderate risk compared to more volatile sector-specific indices.

Potential Returns Compared to Other Investments

EIAs offer a moderate risk-return profile. They typically offer lower potential returns than pure equity investments but higher returns than traditional fixed-income instruments.

Potential Risks of EIA Investments

- Limited upside potential due to cap rates.

- Fees and expenses can reduce returns.

- Market downturns can limit returns to the minimum guaranteed rate.

- Liquidity constraints: accessing funds may be restricted.

- Complexity: understanding the contract terms is crucial.

Regulatory Considerations: Which Of The Following Are Equity-indexed Annuities Typically Invested In

EIAs are subject to regulatory oversight to protect consumers and ensure transparency. Understanding these regulations is crucial for making informed investment decisions.

Regulatory Oversight

Insurance regulators at the state level oversee EIAs, ensuring compliance with consumer protection laws and solvency requirements of the insurance companies.

Consumer Protection Measures

Regulations require clear disclosure of fees, charges, and the terms of the contract. They also aim to prevent misleading sales practices.

Disclosure Requirements, Which of the following are equity-indexed annuities typically invested in

EIAs require detailed disclosures regarding the index used, participation rates, cap rates, fees, and surrender charges.

Potential Downsides of Investing in EIAs

- Complex contract terms.

- High fees and expenses.

- Limited liquidity.

- Potential for lower returns than other investments.

- Surrender charges if the contract is terminated early.

Illustrative Examples of EIA Investments

Let’s examine how an EIA might invest in a broad market index and react to market volatility.

EIA Investment in a Broad Market Index

An EIA linked to the S&P 500 might allocate its assets to track the index’s composition, potentially using exchange-traded funds (ETFs) or other instruments that replicate the index’s performance.

Impact of Market Volatility

During market downturns, the EIA’s return would be limited to the minimum guaranteed rate, protecting the investor from significant losses. However, the potential for substantial gains during market upturns would also be limited by the cap rate.

Investment Strategy During a Market Downturn

The insurer’s strategy during a market downturn would primarily focus on managing risk and meeting its guarantee obligations. This might involve adjusting the underlying portfolio’s asset allocation, but the contract’s terms would remain unchanged.

Asset Allocation Across Different Sectors

While an EIA primarily tracks a specific index, the insurer might diversify its underlying investments to manage risk, potentially including assets outside the index’s components.

Comparing EIA Investment Options

Different EIA providers offer varying investment options, fees, and features. Careful comparison is essential for selecting the most suitable product.

Comparison of EIA Providers

The choice of provider depends on factors such as the offered indices, participation rates, cap rates, fees, and the insurer’s financial strength.

Factors Influencing Index Choice

The investor’s risk tolerance and investment goals should guide the choice of underlying index. A more conservative investor might prefer a broad market index, while a more aggressive investor might consider a sector-specific index.

Differences in Fees and Expenses

Fees and expenses vary significantly across providers. These include mortality and expense risk charges, administrative fees, and surrender charges. Careful comparison of the overall cost is crucial.

| Provider | Index | Participation Rate | Cap Rate | Annual Fee |

|---|---|---|---|---|

| Provider A | S&P 500 | 70% | 9% | 1.25% |

| Provider B | S&P 500 | 80% | 10% | 1.50% |

| Provider C | Nasdaq 100 | 75% | 11% | 1.00% |