Should You Pay Off Your Mortgage or Invest?: Is It Better To Pay Off Mortgage Or Invest

Is it better to pay off mortgage or invest – The age-old question of whether to prioritize paying off your mortgage or investing your money is a complex one, with no single right answer. The optimal strategy depends heavily on your individual financial situation, risk tolerance, and long-term goals. This article will explore the key financial factors, personal circumstances, and strategic considerations that should inform your decision.

Financial Factors Influencing the Decision

A thorough financial analysis is crucial before deciding between paying down your mortgage and investing. This involves comparing the cost of your mortgage against the potential returns from investments, considering tax implications, and anticipating the impact of inflation.

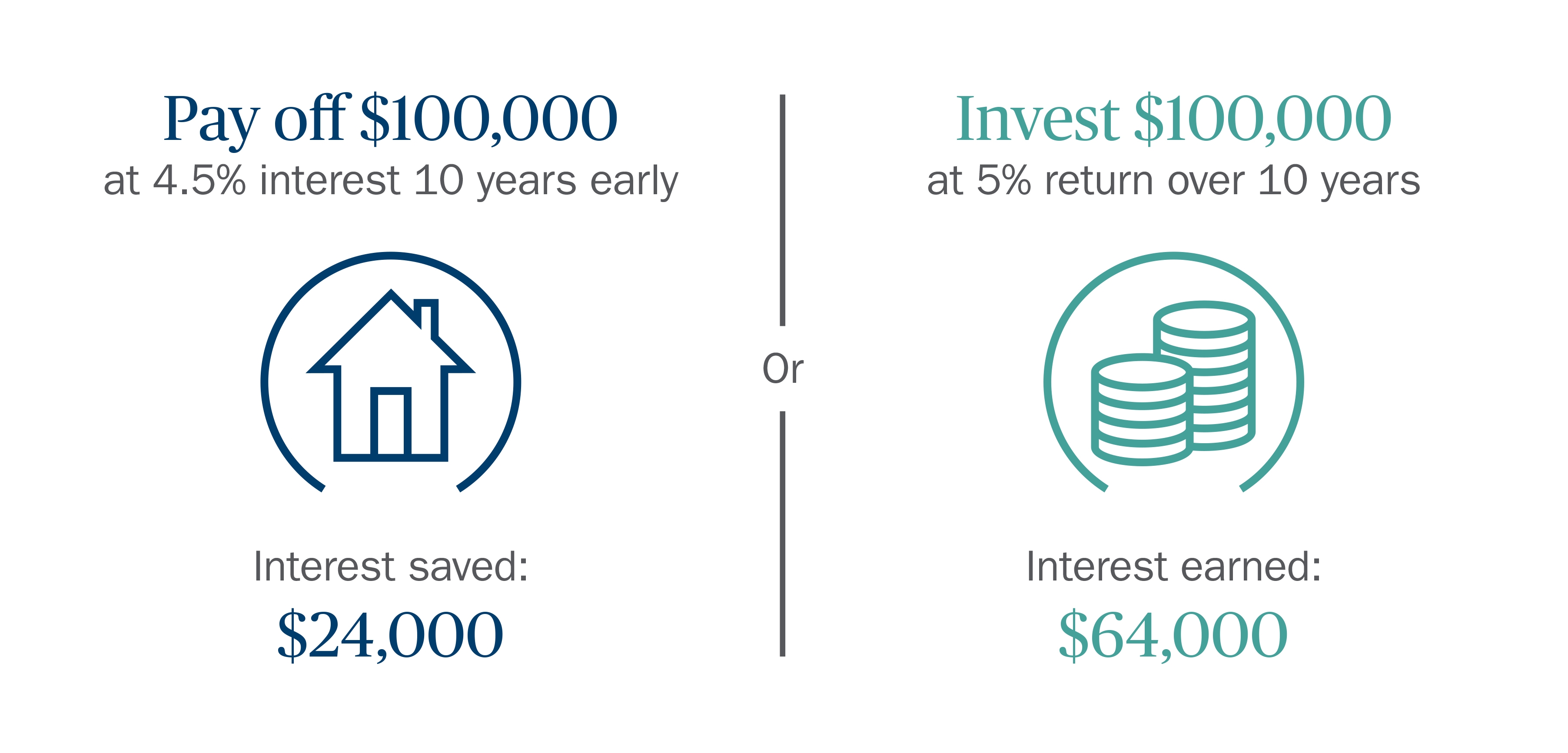

Comparing Mortgage Interest Rates and Investment Returns: A key consideration is comparing your mortgage interest rate to your potential investment returns. If your mortgage interest rate is significantly higher than the potential return on your investments, paying down the mortgage may be more financially advantageous. However, if you can achieve higher returns through investments, prioritizing investment may be a better choice. For example, a 4% mortgage interest rate may be less appealing than a potential 7% annual return on a well-diversified stock portfolio.

Mortgage Maintenance Costs: Remember to factor in all associated costs, including property taxes, homeowner’s insurance, and potential maintenance expenses. These costs can significantly impact your overall financial picture and should be included in your calculations.

Tax Benefits of Mortgage Interest Deductions: In some countries, mortgage interest payments are tax-deductible, reducing your taxable income. This tax benefit should be considered when comparing the overall cost of your mortgage to potential investment returns. The extent of this benefit varies depending on local tax laws.

Inflation’s Impact: Inflation erodes the purchasing power of money over time. A high inflation rate can decrease the real value of your mortgage payments while potentially increasing the value of certain investments, like real estate or stocks, that can keep pace with inflation. A scenario with 3% inflation would see mortgage payments increase slightly while investments might also increase, but a 7% inflation would see a drastic increase in mortgage payments and potentially even greater growth in some investments.

Investment Vehicles and Associated Risks: Various investment vehicles, such as stocks, bonds, real estate investment trusts (REITs), and mutual funds, offer different risk-return profiles. Stocks generally offer higher potential returns but also carry greater risk, while bonds are considered less risky but typically offer lower returns. Real estate can be a good hedge against inflation but requires significant capital and involves ongoing maintenance costs. Diversification across different asset classes is key to mitigating risk.

Personal Financial Situation and Goals

Your personal financial situation and goals are equally important in determining the best course of action. This includes assessing your risk tolerance, managing emergency funds, and aligning your financial decisions with your long-term aspirations.

Risk Tolerance: Your comfort level with risk plays a vital role. If you’re risk-averse, prioritizing mortgage payoff might provide more peace of mind. If you have a higher risk tolerance and a longer time horizon, you may be more comfortable allocating a greater portion of your funds to potentially higher-return investments.

Emergency Fund Management: Before investing heavily, ensure you have a sufficient emergency fund (ideally 3-6 months of living expenses) to cover unexpected events. This fund provides a financial safety net, allowing you to weather unforeseen circumstances without jeopardizing your investments or mortgage payments.

Calculating Net Worth and Debt-to-Income Ratio: Understanding your net worth (assets minus liabilities) and debt-to-income ratio (monthly debt payments divided by gross monthly income) provides a clear picture of your financial health. These metrics help you make informed decisions about your debt management and investment strategies.

Impact of Financial Goals: Your long-term goals, such as retirement planning, children’s education, or purchasing a second property, significantly influence your decision. If retirement is a priority, investing may be more crucial, while if early mortgage payoff provides significant peace of mind, that might take precedence.

Long-Term Financial Implications:

| Scenario | Mortgage Payoff Timeline | Investment Growth (Estimated) | Net Worth |

|---|---|---|---|

| Aggressive Mortgage Payoff | 5 years | Lower | Moderately Higher |

| Balanced Approach | 10 years | Moderate | Higher |

| Investment Focused | 15 years | High | Significantly Higher |

| No Change | 30 years | Potentially High | Potentially High |

Note: These are illustrative examples. Actual results will vary based on market conditions and individual circumstances.

Mortgage Characteristics and Repayment Strategies, Is it better to pay off mortgage or invest

Understanding your mortgage’s characteristics and exploring different repayment strategies can significantly impact your overall financial outcome. This includes considering mortgage types, extra payments, and refinancing options.

Mortgage Types: Fixed-rate mortgages offer predictable monthly payments, while adjustable-rate mortgages (ARMs) have fluctuating interest rates, potentially leading to higher payments over time. The choice depends on your risk tolerance and long-term financial outlook.

Impact of Extra Payments: Making extra mortgage payments can substantially reduce your loan’s repayment period and overall interest paid. Even small extra payments can significantly shorten the mortgage timeline.

Refinancing Implications: Refinancing can lower your interest rate, potentially saving you money over the life of the loan. However, closing costs and other fees should be considered.

Strategies for Accelerated Payoff: Several strategies can accelerate mortgage payoff, such as the snowball method (paying off smallest debts first), the avalanche method (paying off highest interest debts first), and bi-weekly payments.

- Assess your current mortgage terms and interest rate.

- Calculate how much extra you can afford to pay each month.

- Choose a repayment strategy (snowball, avalanche, etc.).

- Make consistent extra payments.

- Regularly monitor your progress and adjust your strategy as needed.

Investment Strategies and Portfolio Diversification

Effective investment strategies and portfolio diversification are essential for maximizing returns and mitigating risk. This section Artikels key concepts and strategies for building a well-diversified investment portfolio.

Importance of Diversification: Diversification spreads your investments across different asset classes, reducing the overall risk of significant losses. A diversified portfolio includes stocks, bonds, and potentially other assets.

Investment Strategies: Different investment strategies exist, including value investing (focusing on undervalued assets), growth investing (seeking high-growth companies), and index fund investing (tracking a market index). The choice depends on your investment goals and risk tolerance.

Role of Asset Allocation: Asset allocation involves determining the proportion of your portfolio invested in each asset class. This is crucial for managing risk and aligning your portfolio with your investment objectives.

Building a Diversified Portfolio: A diversified portfolio typically includes a mix of stocks (for growth), bonds (for stability), and potentially real estate or other alternative investments. The specific asset allocation depends on your risk tolerance and time horizon. For example, a younger investor with a longer time horizon might allocate a larger portion to stocks, while an older investor closer to retirement might prefer a more conservative allocation with a higher proportion of bonds.

Hypothetical Portfolio for Early Mortgage Payoff: An investor aiming for early mortgage payoff might allocate a portion of their portfolio to more conservative investments, such as high-yield savings accounts or certificates of deposit (CDs), to ensure they have sufficient liquidity for extra mortgage payments. A smaller portion might be allocated to growth-oriented investments to benefit from potential long-term growth.

Unexpected Life Events and Contingency Planning

Unexpected life events can significantly impact both your mortgage payments and investments. A robust contingency plan is crucial for mitigating risk and ensuring financial stability during challenging times.

Impact of Job Loss: Job loss can severely affect your ability to make mortgage payments and maintain your investment strategy. Having an emergency fund and exploring options like unemployment benefits are crucial.

Incorporating Emergency Funds: An emergency fund is essential for navigating unexpected expenses without disrupting your long-term financial plans. Aim for 3-6 months of living expenses.

Impact of Medical Expenses: Unexpected medical expenses can quickly deplete your savings and disrupt your financial stability. Health insurance and a robust emergency fund are crucial.

Debt Management Strategies: Strategies for managing debt during unforeseen circumstances include negotiating with creditors, seeking debt consolidation, or exploring government assistance programs.

- Job Loss: Potential mortgage default, forced sale of assets, disruption of investment strategies.

- Medical Emergency: Increased debt, potential need to liquidate investments, possible mortgage default.

- Unexpected Home Repairs: Increased debt, potential need to tap into savings or investments.

- Family Emergency: Potential need for financial assistance, possible disruption of investment strategies.