Understanding S&P 500 Index Funds

How to invest in s p 500 index fund – Investing in an S&P 500 index fund offers a straightforward way to gain broad exposure to the US stock market. This section details the composition, benefits, and various types of these funds, alongside a comparison of their expense ratios.

S&P 500 Index Composition

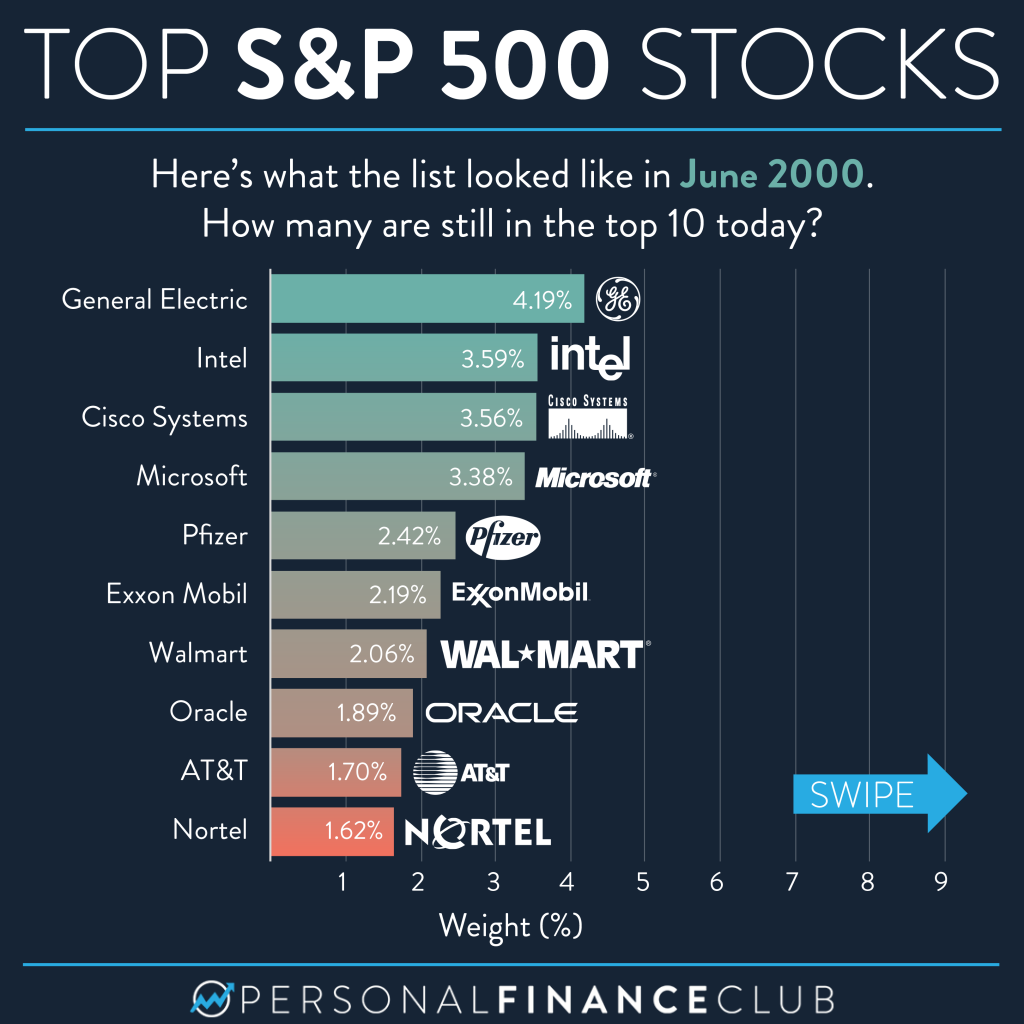

The S&P 500 index tracks the performance of 500 of the largest publicly traded companies in the United States. These companies represent a wide range of sectors, including technology, healthcare, financials, consumer goods, and industrials. The index is market-capitalization-weighted, meaning larger companies have a greater influence on the overall index value.

Benefits of Investing in S&P 500 Index Funds

Investing in an S&P 500 index fund offers several key advantages. These include diversification, low cost, and historically strong returns. Diversification reduces risk by spreading investments across numerous companies. Low costs are achieved through passive management, tracking the index rather than actively trying to beat it. Historically, the S&P 500 has delivered solid returns over the long term.

S&P 500 Index Fund Types: ETFs vs. Mutual Funds

S&P 500 index funds are available as exchange-traded funds (ETFs) and mutual funds. ETFs trade like stocks on exchanges, offering intraday liquidity. Mutual funds are purchased directly from the fund company and are priced at the end of the trading day. Both provide broad market exposure, but ETFs generally have lower expense ratios and higher trading flexibility.

Expense Ratio Comparison of S&P 500 Index Funds

Expense ratios are a crucial factor to consider. They represent the annual cost of owning the fund, expressed as a percentage of assets under management. Lower expense ratios translate to higher returns over time.

| Fund Name | Expense Ratio | Minimum Investment | Investment Strategy |

|---|---|---|---|

| Vanguard S&P 500 ETF (VOO) | 0.03% | Variable (brokerage dependent) | Passive, market-cap weighted |

| iShares CORE S&P 500 ETF (IVV) | 0.03% | Variable (brokerage dependent) | Passive, market-cap weighted |

| Schwab S&P 500 Index Fund (SWTSX) | 0.02% | $0 | Passive, market-cap weighted |

| Fidelity ZERO S&P 500 Index Fund (FZROX) | 0.00% | $0 | Passive, market-cap weighted |

Choosing an S&P 500 Index Fund Brokerage Account

Selecting the right brokerage account is critical for successful S&P 500 index fund investing. This section Artikels key features to consider, including commission structures, account security, and fraud prevention.

Brokerage Account Features, How to invest in s p 500 index fund

When choosing a brokerage, consider factors such as account fees, research tools, investment options, mobile app functionality, customer service, and educational resources. A user-friendly platform and strong customer support are essential for a positive investing experience.

Brokerage Commission Structures

Many brokerages now offer commission-free trading for stocks and ETFs, making it easier to invest in S&P 500 index funds without incurring transaction costs. However, it’s crucial to examine all fees, including account maintenance fees, inactivity fees, and potential margin interest.

Account Security and Fraud Prevention

Protecting your investment account from unauthorized access and fraudulent activity is paramount. Look for brokerages with robust security measures, including two-factor authentication, encryption, and fraud monitoring systems. Regularly review your account statements for any suspicious activity.

Comparison of Popular Brokerage Platforms

Different brokerage platforms offer varying features and services. Choosing the right one depends on your individual needs and investment style.

| Brokerage | Commission Structure | Account Minimum | Key Features |

|---|---|---|---|

| Fidelity | Generally commission-free | $0 | Wide range of investment options, research tools, educational resources |

| Charles Schwab | Generally commission-free | $0 | Strong research platform, excellent customer service |

| Vanguard | Generally commission-free | $0 | Low-cost funds, user-friendly platform |

| Interactive Brokers | Low commissions | Variable | Advanced trading tools, international access |

Investing Strategies for S&P 500 Index Funds

Several approaches exist for investing in S&P 500 index funds. This section examines lump-sum investing, dollar-cost averaging, and factors influencing investment timelines, along with a step-by-step guide to purchasing the funds.

Investment Approaches: Lump Sum vs. Dollar-Cost Averaging

A lump-sum investment involves investing a large amount of money at once. Dollar-cost averaging involves investing smaller amounts at regular intervals. Lump-sum investing benefits from potential compounding gains, while dollar-cost averaging reduces the risk of market timing.

Risks and Rewards of Investment Strategies

Lump-sum investing carries higher risk if the market declines immediately after investment. Dollar-cost averaging mitigates this risk but may result in lower overall returns if the market rises steadily. The optimal strategy depends on individual risk tolerance and market outlook.

Determining Your Investment Timeline

Your investment timeline should align with your financial goals. Longer timelines allow for greater potential returns but also expose you to greater market fluctuations. Shorter timelines necessitate a more conservative approach.

Step-by-Step Guide to Purchasing S&P 500 Index Funds

Investing in S&P 500 index funds is relatively straightforward.

- Open a brokerage account.

- Fund your account.

- Search for your chosen S&P 500 index fund (e.g., VOO, IVV).

- Specify the number of shares to purchase.

- Review and confirm your order.

Diversification and Asset Allocation with S&P 500 Index Funds: How To Invest In S P 500 Index Fund

S&P 500 index funds play a crucial role in a diversified portfolio. This section explains how to determine appropriate asset allocation based on risk tolerance and investment goals, and compares the S&P 500 with other asset classes.

S&P 500’s Role in a Diversified Portfolio

An S&P 500 index fund provides broad market exposure, reducing risk by diversifying across various sectors and companies. However, a portfolio solely invested in stocks is susceptible to market volatility. Diversification into other asset classes is crucial for risk management.

Determining Asset Allocation

Asset allocation involves determining the proportion of your portfolio invested in different asset classes (stocks, bonds, real estate, etc.). This depends on your risk tolerance (your comfort level with potential losses) and investment goals (e.g., retirement, down payment). Younger investors with longer time horizons can generally tolerate higher stock allocations.

S&P 500 vs. Other Asset Classes

The S&P 500 represents a segment of the equity market. Bonds offer lower returns but less volatility than stocks. Real estate can provide diversification and potential income through rental payments but involves higher transaction costs and less liquidity.

Sample Diversified Portfolio

A sample diversified portfolio might allocate 60% to stocks (including an S&P 500 index fund), 30% to bonds, and 10% to real estate. This is a general example; the optimal allocation varies depending on individual circumstances.

Monitoring and Rebalancing Your S&P 500 Index Fund Investments

Regular monitoring and rebalancing are essential for maintaining a well-diversified portfolio and optimizing returns. This section details the importance of monitoring investment performance, explains rebalancing, and provides a schedule for portfolio review and rebalancing.

Monitoring Investment Performance

Regularly reviewing your portfolio’s performance helps you track progress toward your financial goals and identify any potential issues. Monitor your returns, asset allocation, and expense ratios. Most brokerage platforms provide online tools for easy tracking.

Rebalancing Your Portfolio

Rebalancing involves adjusting your portfolio’s asset allocation to restore the target percentages. Over time, some asset classes will outperform others, causing your portfolio to drift from its original allocation. Rebalancing involves selling some of the better-performing assets and buying more of the underperforming ones.

Schedule for Reviewing and Rebalancing

A suitable schedule for reviewing and rebalancing is annually or semi-annually. More frequent rebalancing might be appropriate for more volatile portfolios or significant market changes.

Calculating Return on Investment (ROI)

ROI is calculated by subtracting the initial investment from the final value, dividing the result by the initial investment, and multiplying by 100 to express it as a percentage. For example: (Final Value – Initial Investment) / Initial Investment * 100 = ROI%

Tax Implications of Investing in S&P 500 Index Funds

Understanding the tax implications of investing in S&P 500 index funds is crucial for minimizing your tax liability. This section discusses capital gains taxes, dividend taxes, strategies for tax minimization, and tax-advantaged accounts.

Capital Gains and Dividend Taxes

Capital gains taxes are levied on profits from selling investments. Dividend taxes are levied on dividend income received from stocks. The tax rates depend on your income bracket and how long you held the investment (long-term vs. short-term).

Strategies for Minimizing Tax Liability

Strategies for minimizing tax liability include holding investments in tax-advantaged accounts and harvesting tax losses (selling losing investments to offset gains).

Resources for Further Information

Consult a qualified financial advisor or tax professional for personalized advice. The IRS website also provides comprehensive information on tax regulations.

Tax-Advantaged Accounts

Tax-advantaged accounts offer significant benefits for long-term investors.

- 401(k): Employer-sponsored retirement plan offering tax-deferred growth.

- IRA (Individual Retirement Account): Allows for tax-deductible contributions or tax-free growth, depending on the type of IRA.

- Roth IRA: Contributions are made after tax, but withdrawals in retirement are tax-free.