Understanding Basic Investment Concepts

How do you get started investing in the stock market – Before diving into the stock market, grasping fundamental investment concepts is crucial. This section clarifies key differences between investment types, defines common terminology, and assesses the risk-return profiles of various investment options.

Stocks versus Bonds

Stocks represent ownership in a company, offering potential for high growth but also significant risk. Bonds, conversely, are loans to a company or government, providing a fixed income stream with lower risk but typically slower growth potential. Stock prices fluctuate based on market sentiment and company performance, while bond prices are influenced by interest rates and creditworthiness.

Types of Stock Market Investments

The stock market offers diverse investment vehicles catering to different risk tolerances and financial goals. Understanding these options is vital for crafting a suitable investment strategy.

- Individual Stocks: Investing directly in shares of a specific company offers high potential returns but also carries substantial risk. Thorough research is paramount.

- Exchange-Traded Funds (ETFs): ETFs are baskets of securities that trade on exchanges like stocks, offering diversification and lower expense ratios than many mutual funds.

- Mutual Funds: Professionally managed portfolios of stocks, bonds, or other assets. They provide diversification but may have higher expense ratios than ETFs.

Common Investment Terms

Familiarizing yourself with common investment terms is essential for effective market navigation.

- Dividend: A payment made by a company to its shareholders, usually from its profits.

- P/E Ratio (Price-to-Earnings Ratio): A valuation metric comparing a company’s stock price to its earnings per share. A high P/E ratio may suggest the stock is overvalued.

- Market Capitalization: The total market value of a company’s outstanding shares (stock price x number of shares).

Risk and Return Comparison

The risk-return tradeoff is a fundamental principle in investing. Higher potential returns generally come with higher risk.

| Investment Type | Risk | Potential Return | Liquidity |

|---|---|---|---|

| Individual Stocks | High | High | High |

| ETFs | Medium | Medium | High |

| Mutual Funds | Medium to Low | Medium to Low | High |

| Bonds | Low | Low | Medium to High (depending on the bond) |

Opening a Brokerage Account

A brokerage account is your gateway to the stock market. Choosing a reputable firm and understanding account types are critical first steps.

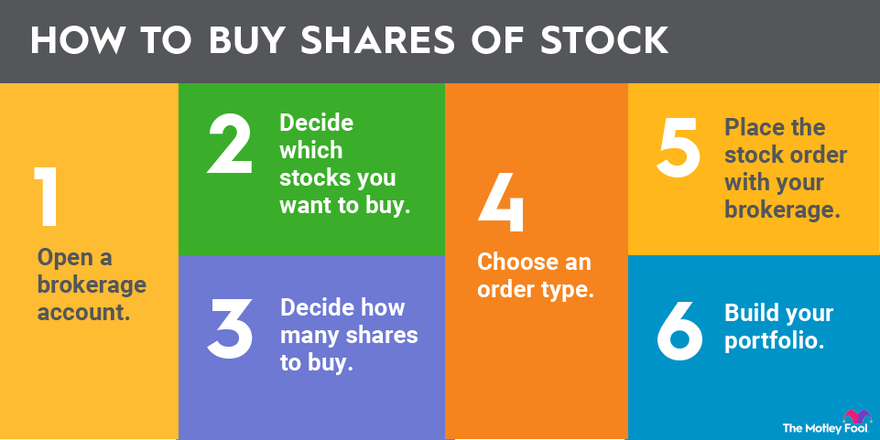

Step-by-Step Account Opening

- Choose a Brokerage: Research different brokers, comparing fees, features, and investment options.

- Complete the Application: Provide personal information, tax identification, and banking details.

- Fund Your Account: Deposit funds via bank transfer, check, or other methods.

- Start Investing: Once your account is funded, you can begin researching and purchasing securities.

Brokerage Platform Comparison

Several reputable brokerage platforms cater to diverse investor needs. Consider factors like fees, research tools, and investment options when making your choice. Robinhood, Fidelity, and Schwab are examples of popular platforms, each with its own strengths and weaknesses.

Account Opening Checklist

- Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Valid government-issued ID

- Bank account information

- Investment goals and risk tolerance

Account Types

Different account types cater to various investment goals and tax situations.

- Individual Accounts: For individual investors.

- Joint Accounts: For multiple investors.

- Retirement Accounts (IRAs, 401(k)s): Tax-advantaged accounts for retirement savings.

Researching and Selecting Investments

Thorough research is crucial for successful investing. This section Artikels methods for analyzing potential investments and evaluating a company’s financial health.

Investment Research Methods

Two primary approaches guide investment decisions:

- Fundamental Analysis: Evaluating a company’s intrinsic value by examining its financial statements, business model, and competitive landscape.

- Technical Analysis: Analyzing past market trends and price patterns to predict future price movements.

Reliable Sources of Financial Information

Access credible information from diverse sources to make informed decisions.

- Company Websites: Access financial reports, investor relations materials, and press releases.

- Financial News Outlets: Reputable news sources provide market analysis and company news (e.g., The Wall Street Journal, Bloomberg, Reuters).

- Securities and Exchange Commission (SEC) Filings (EDGAR database): Access official company disclosures.

Evaluating Company Financial Health

Analyze key financial metrics to assess a company’s financial strength and stability.

- Revenue and Earnings Growth: Indicates the company’s ability to generate sales and profits.

- Debt-to-Equity Ratio: Measures the proportion of debt to equity financing, reflecting the company’s financial leverage.

- Profit Margins: Show the company’s profitability relative to its revenue.

Portfolio Diversification Factors

Diversification reduces risk by spreading investments across different asset classes and sectors.

- Asset Allocation: Determine the appropriate mix of stocks, bonds, and other assets based on risk tolerance and investment goals.

- Sector Diversification: Avoid overexposure to any single industry.

- Geographic Diversification: Invest in companies from different countries to reduce country-specific risks.

Developing an Investment Strategy

A well-defined investment strategy aligns with your financial goals and risk tolerance. This section explores various strategies and Artikels a sample plan for beginners.

Investment Strategies

Different strategies cater to varying risk profiles and investment horizons.

- Value Investing: Identifying undervalued companies with strong fundamentals.

- Growth Investing: Focusing on companies with high growth potential, even if currently overvalued.

- Index Fund Investing: Investing in a fund that tracks a specific market index, offering broad diversification and low costs.

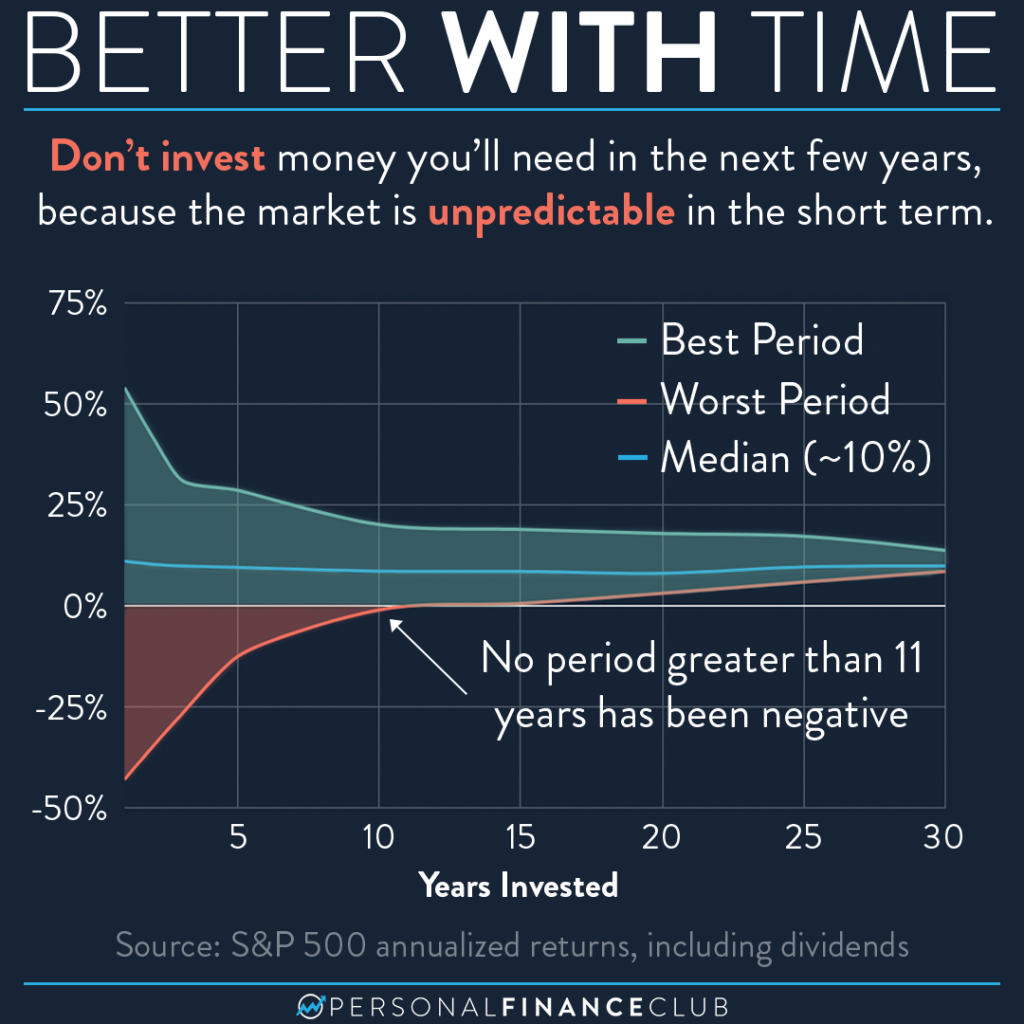

Long-Term versus Short-Term Strategies

Long-term strategies focus on steady growth over an extended period, typically minimizing trading and maximizing long-term returns. Short-term strategies aim for quick profits, often involving frequent trading and higher risk.

Sample Investment Plan for Beginners

A hypothetical example: A beginner with a moderate risk tolerance might allocate 60% to a low-cost index fund (S&P 500), 30% to a bond ETF, and 10% to a small selection of individual stocks after thorough research.

Investment Risks

All investments carry inherent risks. Understanding these risks is vital for making informed decisions.

- Market Risk: Fluctuations in overall market conditions.

- Company-Specific Risk: Risks associated with individual companies, such as financial distress or management changes.

- Interest Rate Risk: The impact of changing interest rates on bond prices.

Managing Your Investments

Active portfolio management is crucial for maximizing returns and mitigating risks. This section details strategies for monitoring, rebalancing, and tracking investment performance.

Portfolio Monitoring

Regularly reviewing your portfolio’s performance and adjusting your strategy as needed is vital. This includes monitoring individual investments, overall portfolio performance, and market conditions.

Risk Management and Loss Mitigation

Strategies to manage risk include diversification, stop-loss orders (to limit potential losses on individual stocks), and dollar-cost averaging (investing a fixed amount at regular intervals, regardless of price fluctuations).

Portfolio Rebalancing, How do you get started investing in the stock market

Periodically rebalancing your portfolio involves adjusting asset allocations to maintain your target asset mix. This helps to re-establish your desired risk level and take advantage of market fluctuations.

Tracking Investment Performance

Many brokerage platforms offer tools for tracking investment performance, including charts, graphs, and reports. You can also use spreadsheets or dedicated financial software.

Understanding Taxes and Fees

Tax implications and brokerage fees significantly impact your investment returns. This section details these factors and strategies for minimizing tax liabilities.

Tax Implications of Investing

Capital gains taxes are levied on profits from selling investments. The tax rate depends on the holding period and your income bracket. Dividend income is also taxable.

Brokerage Fees and Commissions

Brokerage fees vary across platforms and investment types. Common fees include trading commissions, account maintenance fees, and advisory fees.

Tax Implications for Different Investment Vehicles

| Investment Vehicle | Tax Implications | Tax Advantages |

|---|---|---|

| Individual Stocks | Capital gains tax on sale; dividends taxed as income | None |

| ETFs | Capital gains tax on sale; dividends taxed as income (may vary by ETF) | Potentially lower expense ratios than mutual funds |

| Mutual Funds | Capital gains tax on sale; dividends taxed as income (may vary by fund) | Diversification; professional management |

| Bonds | Interest income taxed as ordinary income | Potentially lower risk than stocks |

| Tax-Advantaged Accounts (IRAs, 401(k)s) | Tax deferred or tax-free growth, depending on the account type | Significant tax benefits for retirement savings |

Minimizing Tax Liabilities

Strategies for minimizing taxes include tax-loss harvesting (selling losing investments to offset gains), maximizing contributions to tax-advantaged accounts, and seeking professional tax advice.

Additional Resources and Education: How Do You Get Started Investing In The Stock Market

Continuous learning is vital for successful investing. This section provides resources for expanding your financial knowledge.

Reputable Websites and Educational Resources

- Investopedia

- The Motley Fool

- Khan Academy (finance section)

Finding a Financial Advisor or Mentor

Consider seeking guidance from a qualified financial advisor, especially when making complex investment decisions. Networking and online platforms can help you find mentors.

Books and Courses

Numerous books and courses offer in-depth knowledge on various aspects of investing. Look for reputable sources with a proven track record.

Importance of Continuous Learning

The financial landscape constantly evolves. Staying updated on market trends, investment strategies, and regulatory changes is crucial for long-term success.