Long-Term Investment Strategies for 2025 and Beyond

Best stocks to invest in 2025 for long-term – Investing for the long term requires a different approach than short-term trading. It prioritizes sustainable growth over quick profits, focusing on fundamental analysis and diversification to mitigate risk. This strategy allows investors to ride out market fluctuations and benefit from the power of compounding returns. This article Artikels key considerations for building a successful long-term investment portfolio for 2025 and beyond.

Principles and Benefits of Long-Term Investing

Long-term investing hinges on the belief that markets, over time, tend to trend upwards. This approach minimizes the impact of short-term market volatility. Benefits include the potential for higher returns due to compounding, reduced stress from frequent trading, and a more tax-efficient investment strategy due to lower transaction frequency. Successful long-term investors, such as Warren Buffett, famously employ a buy-and-hold strategy, focusing on fundamentally sound companies with strong long-term growth prospects. Other successful strategies include value investing, growth investing, and index fund investing, each with its own approach to identifying and selecting investments.

Comparative Analysis of Investment Philosophies

Different investment philosophies suit varying risk tolerances and time horizons. Value investing focuses on undervalued companies with strong fundamentals, while growth investing targets companies with high growth potential, even if currently overvalued. Index fund investing passively tracks a market index, providing broad diversification. For a 2025 long-term horizon, a balanced approach combining value and growth stocks, potentially augmented with index funds, may be suitable. This allows participation in both established and emerging market sectors.

Hypothetical Portfolio Diversification Strategy

A diversified portfolio minimizes risk by spreading investments across various asset classes. A hypothetical example for 2025 might allocate 40% to equities (20% US large-cap, 10% international equities, 10% emerging markets), 30% to bonds (15% government bonds, 15% corporate bonds), 20% to real estate (through REITs or direct property investment), and 10% to alternative investments (e.g., commodities or private equity). This allocation is illustrative and should be adjusted based on individual risk tolerance and financial goals.

Analyzing Economic Forecasts for 2025 and Beyond

Predicting the future is inherently uncertain, but analyzing economic trends provides valuable insights for investment decisions. Factors such as inflation, interest rates, geopolitical events, and technological advancements significantly influence stock valuations and sector performance. Understanding these factors allows investors to make more informed decisions.

Economic Growth Scenarios and Sectoral Impacts

Several economic growth scenarios are possible for 2025 and beyond. A robust global growth scenario would likely favor cyclical sectors like consumer discretionary and industrials. Conversely, a slower growth scenario might benefit defensive sectors like utilities and consumer staples. Technological advancements continue to disrupt traditional industries, creating both opportunities and challenges for investors.

Inflation, Interest Rates, and Stock Valuations

Inflation and interest rates have a significant impact on stock valuations. High inflation typically leads to higher interest rates, which can reduce the present value of future earnings, negatively impacting stock prices. Conversely, low inflation and low interest rates can stimulate economic growth and boost stock valuations. The Federal Reserve’s monetary policy plays a crucial role in influencing these variables.

Geopolitical Risks and Global Market Influence

Geopolitical events, such as trade wars, political instability, and conflicts, can significantly impact global stock markets. These events create uncertainty and volatility, requiring investors to carefully assess the potential risks and opportunities associated with specific regions and countries. Diversification across geographies helps mitigate these risks.

Economic Outlooks of Major Economies

Comparing the economic outlooks of major economies like the US, China, and the EU is crucial for stock selection. Strong economic growth in one region might benefit companies operating in that region, while economic slowdowns could negatively impact their performance. Currency fluctuations also play a significant role in international investments.

Sector-Specific Investment Opportunities in 2025

Certain sectors are expected to experience significant growth in 2025 and beyond. Technology, renewable energy, and healthcare are prime examples, each presenting unique investment opportunities and risks.

Growth Prospects of the Technology Sector

The technology sector continues to be a major driver of economic growth. Sub-sectors like artificial intelligence, cloud computing, and cybersecurity are expected to experience substantial growth. Investing in companies at the forefront of these innovations could yield significant returns, but this sector is also known for its volatility.

Analysis of the Renewable Energy Sector

The renewable energy sector is poised for significant growth driven by increasing concerns about climate change and government policies promoting clean energy. Key players include companies involved in solar power, wind power, and energy storage. Investing in this sector contributes to environmental sustainability while potentially offering attractive returns.

Investment Opportunities in Healthcare

The healthcare sector offers diverse investment opportunities, particularly in pharmaceuticals and biotechnology. Advances in medical technology and the aging global population drive demand for healthcare products and services. However, this sector is also characterized by high regulatory hurdles and long development cycles.

Comparison of Sectoral Returns and Risks

| Sector | Potential Return | Risk | Key Considerations |

|---|---|---|---|

| Technology | High | High | Focus on disruptive technologies and strong management teams. |

| Renewable Energy | Medium-High | Medium | Consider government policies and technological advancements. |

| Healthcare | Medium-High | Medium | Evaluate regulatory risks and the length of drug development cycles. |

Evaluating Individual Company Performance

Thorough due diligence is crucial before investing in any company. This involves evaluating the company’s financial health, competitive landscape, and long-term growth potential. Analyzing key metrics and ratios provides insights into a company’s performance and financial stability.

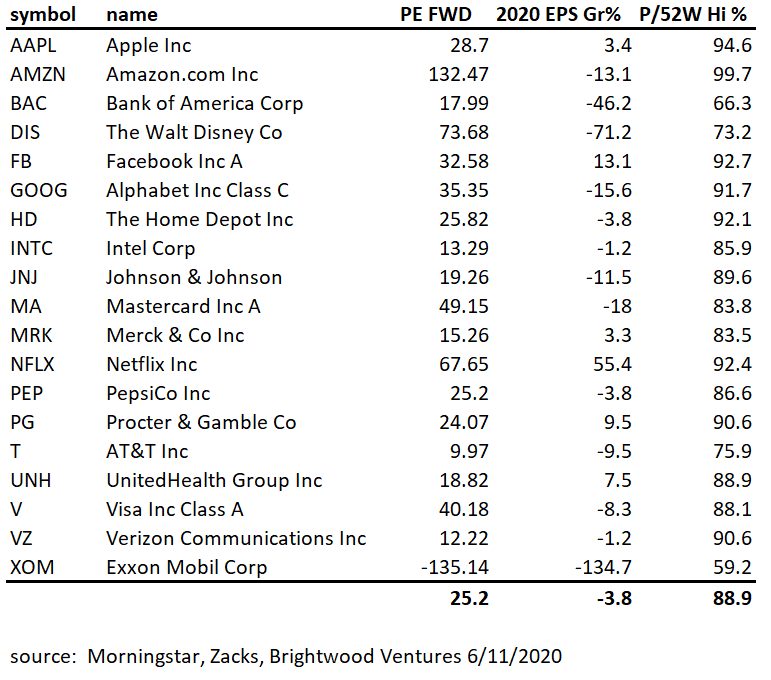

Methods for Evaluating Financial Health

Key metrics include revenue growth, profitability (profit margins, return on equity), debt levels, and cash flow. Ratios such as price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and debt-to-equity ratio provide insights into valuation and financial risk. Analyzing trends in these metrics over time provides a more comprehensive picture.

Understanding Competitive Landscape and Market Position

Assessing a company’s competitive landscape involves analyzing its market share, competitive advantages, and the intensity of competition. Porter’s Five Forces framework can be used to analyze the competitive dynamics of an industry. A company’s strong market position and sustainable competitive advantage are crucial for long-term success.

Factors to Consider for Long-Term Growth Potential

Factors to consider include the company’s innovation capabilities, management team quality, regulatory environment, and overall economic outlook. A company’s ability to adapt to changing market conditions and technological advancements is crucial for long-term growth.

Criteria for Selecting Companies with Strong Management and Sustainable Models

- Experienced and competent management team with a proven track record.

- Clear and well-defined business strategy with a focus on long-term value creation.

- Sustainable competitive advantage, such as strong brand recognition, proprietary technology, or cost leadership.

- Strong corporate governance practices and ethical business conduct.

Managing Risk and Diversification

Risk management is an integral part of long-term investing. Diversification is a key strategy to mitigate risk by spreading investments across different asset classes and geographies. Understanding your own risk tolerance is crucial in shaping your investment decisions.

Importance of Portfolio Diversification

Diversification reduces the impact of losses in any single investment. A well-diversified portfolio can withstand market fluctuations and unexpected events better than a concentrated portfolio. Diversification doesn’t eliminate risk, but it significantly reduces it.

Diversification Strategies

Asset class diversification involves spreading investments across different asset classes, such as stocks, bonds, real estate, and commodities. Geographic diversification involves investing in companies and assets located in different countries to reduce exposure to country-specific risks. Sector diversification further reduces the impact of industry-specific downturns.

Role of Risk Tolerance in Investment Decisions

Risk tolerance is the level of risk an investor is willing to accept. Investors with higher risk tolerance can allocate a larger portion of their portfolio to higher-return, higher-risk assets, while investors with lower risk tolerance may prefer a more conservative approach with lower-risk assets.

Constructing a Diversified Portfolio

A diversified portfolio should align with the investor’s risk tolerance and financial goals. For example, a younger investor with a longer time horizon may allocate a larger portion of their portfolio to equities, while an older investor nearing retirement may prefer a more conservative allocation with a greater emphasis on bonds and fixed-income securities.

Illustrative Examples of Potential Investments: Best Stocks To Invest In 2025 For Long-term

The following examples are for illustrative purposes only and should not be considered investment advice. Conduct thorough due diligence before making any investment decisions.

Companies with Strong Long-Term Growth Potential

Company A (Technology): A leading provider of cloud computing services with a strong track record of innovation and a large customer base. Its future potential lies in expanding its market share in emerging markets and developing new cloud-based solutions. Company B (Renewable Energy): A manufacturer of solar panels with a focus on efficiency and cost reduction. Its future hinges on the continued growth of the renewable energy sector and advancements in solar technology. Company C (Healthcare): A biopharmaceutical company developing innovative treatments for chronic diseases. Its potential lies in successful clinical trials and regulatory approvals for its drug pipeline.

Sectors with Strong Long-Term Growth Potential, Best stocks to invest in 2025 for long-term

Technology: Continued advancements in artificial intelligence, cloud computing, and cybersecurity are expected to drive significant growth in this sector. Renewable Energy: Growing concerns about climate change and government policies supporting clean energy will fuel the expansion of this sector. Healthcare: An aging global population and advances in medical technology will continue to drive demand for healthcare products and services.