Understanding Commodity Investments: A Commodity In Which Someone Invests Might Include A

A commodity in which someone invests might include a – Commodities, raw materials traded on exchanges, offer unique investment opportunities, but understanding their complexities is crucial. This guide explores various commodity types, investment vehicles, influencing factors, and risk management strategies to help you navigate this dynamic market.

Types of Commodities

Commodities are broadly categorized into energy, agriculture, metals, and livestock. Each category exhibits distinct characteristics impacting price volatility and investment risk. Understanding these differences is fundamental to effective commodity investing.

- Energy: Crude oil, natural gas, gasoline, heating oil. Price volatility is heavily influenced by geopolitical events, OPEC decisions, and global demand.

- Agriculture: Corn, wheat, soybeans, coffee, sugar. Weather patterns, global food supply and demand, and government policies significantly impact prices.

- Metals: Gold, silver, platinum, copper, iron ore. Industrial demand, inflation hedging, and currency fluctuations are key price drivers.

- Livestock: Cattle, hogs, poultry. Feed costs, disease outbreaks, and consumer demand influence price fluctuations.

The distinction lies in their underlying uses and sensitivities to external factors. For example, agricultural commodities are susceptible to weather-related events, while energy prices are often linked to geopolitical instability. Metal prices are influenced by industrial activity and inflation, whereas livestock prices respond to changes in consumer demand and feed costs.

Investment Vehicles for Commodities

/derivative.finalJPEG-5c8982d646e0fb00010f11c9.jpg)

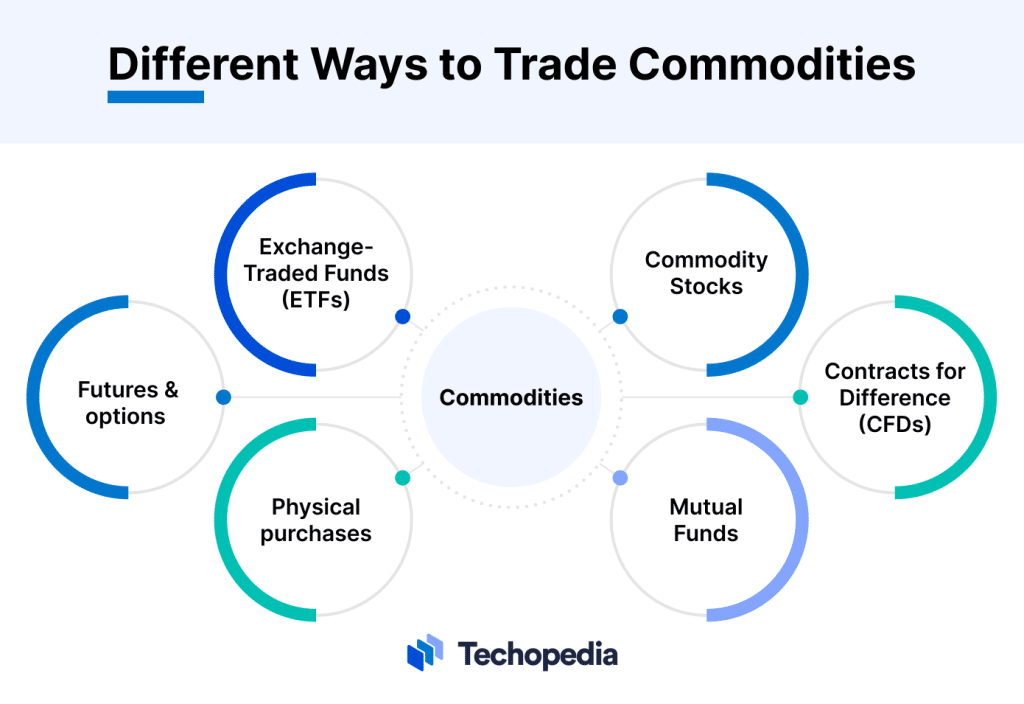

Several avenues exist for investing in commodities, each with its own risk-reward profile. Choosing the right vehicle depends on your investment goals, risk tolerance, and time horizon.

| Investment Vehicle | Liquidity | Risk | Potential Return |

|---|---|---|---|

| Futures Contracts | High | High | High |

| Exchange-Traded Funds (ETFs) | High | Moderate | Moderate |

| Exchange-Traded Notes (ETNs) | High | Moderate | Moderate |

| Physical Commodities | Low | Low to Moderate | Low to Moderate |

Futures contracts offer high leverage and liquidity but carry substantial risk. ETFs and ETNs provide diversified exposure with lower risk, while physical commodities involve storage and handling costs but offer direct ownership.

Factors Influencing Commodity Prices, A commodity in which someone invests might include a

Commodity prices are influenced by a complex interplay of macroeconomic factors, geopolitical events, and supply chain dynamics. Understanding these influences is essential for effective market analysis.

- Macroeconomic Factors: Inflation, interest rates, currency exchange rates, and global economic growth all impact commodity demand and pricing.

- Geopolitical Events: Wars, political instability, and trade disputes can significantly disrupt supply chains and trigger price volatility. The 2022 Russian invasion of Ukraine drastically impacted global energy and grain prices, for instance.

- Supply Chain Disruptions: Natural disasters, pandemics, and logistical bottlenecks can lead to shortages and price spikes. The COVID-19 pandemic caused widespread supply chain disruptions, impacting various commodity markets.

For example, a strong US dollar typically puts downward pressure on commodity prices denominated in other currencies, while rising inflation often boosts demand for precious metals like gold as a hedge against inflation.

Commodity Market Analysis

Analyzing commodity markets requires a structured approach, considering supply and demand dynamics, speculation, and market sentiment. Key indicators provide insights into a commodity’s investment potential.

- Supply and Demand: Analyze production levels, inventory levels, and consumption patterns to assess market balance.

- Speculation and Market Sentiment: Monitor investor behavior, news sentiment, and speculative trading activity to gauge market psychology.

- Technical Analysis: Use charts and indicators to identify trends, support levels, and resistance levels.

- Fundamental Analysis: Assess macroeconomic factors, geopolitical risks, and supply chain dynamics to understand long-term price drivers.

Risk Management in Commodity Investing

Effective risk management is crucial in commodity investing. Diversification, hedging, and stop-loss orders are essential tools to mitigate potential losses.

A hypothetical portfolio might allocate 10% to commodities (diversified across energy, agriculture, and metals), 60% to stocks, and 30% to bonds. This allocation balances the higher risk of commodities with the stability of stocks and bonds, aligning with a moderate risk tolerance.

Case Studies of Commodity Investments

Analyzing successful and unsuccessful commodity investments provides valuable insights into effective strategies and potential pitfalls.

A successful case study might involve a long-term investment in gold during a period of high inflation, while an unsuccessful case might involve a leveraged bet on a specific agricultural commodity that suffered from a significant harvest surplus. Comparing these scenarios reveals the importance of diversification, thorough market analysis, and understanding risk tolerance.

Illustrative Examples of Commodity Investment Strategies

Different investment strategies cater to diverse risk appetites and time horizons. Visual representations, such as line graphs illustrating price movements over time, or bar charts comparing returns across different commodities, would effectively showcase performance for each strategy.

- Long-Term Holding: Investing in commodities like gold or silver with a long-term outlook, expecting price appreciation over time due to inflation or increasing industrial demand. A line graph would show the steady price appreciation over many years.

- Short-Term Trading: Exploiting short-term price fluctuations through futures contracts or options, requiring close market monitoring and a higher risk tolerance. A candlestick chart would effectively depict daily price swings.

- Index Fund Investing: Diversifying across a range of commodities through an index fund, providing broad market exposure with lower management fees. A bar chart comparing the fund’s returns to a benchmark index would illustrate performance.