Identifying False Investment Statements: Fundamentals

Which of the following statements about investing is false – Understanding the difference between sound investment advice and misleading claims is crucial for building a successful investment portfolio. Many common misconceptions and deceptive marketing tactics can lead to poor investment decisions. This section will address common investment myths, misleading advertising claims, and the importance of diversification.

Common Investment Myths

Several pervasive myths cloud sound judgment in investment strategies. Recognizing these falsehoods is the first step towards informed decision-making.

- Myth: High returns always equate to high risk. Reality: While some high-risk investments offer the potential for high returns, many lower-risk investments can also provide significant returns over the long term through consistent growth and compounding.

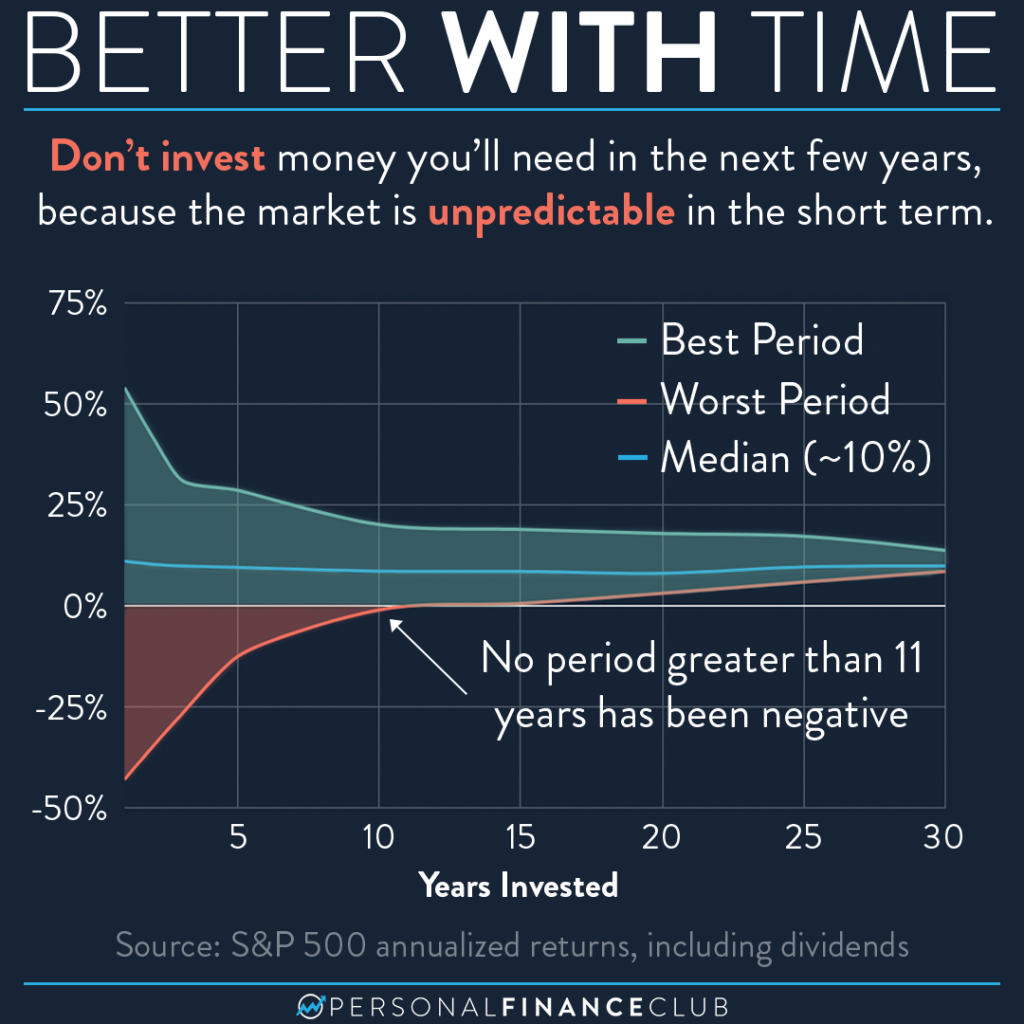

- Myth: Timing the market is consistently profitable. Reality: Accurately predicting market fluctuations is extremely difficult, even for experienced professionals. Attempting to time the market often results in missed opportunities and potential losses.

- Myth: Past performance guarantees future results. Reality: While past performance can be an indicator, it’s not a guarantee of future success. Market conditions, company performance, and other factors can significantly impact future returns.

- Myth: All investments are created equal. Reality: Different investments carry different levels of risk and potential returns. Understanding the nuances of each investment type is essential for making informed decisions.

- Myth: You need a large sum of money to start investing. Reality: Many investment options, such as fractional shares and mutual funds, allow investors to start with relatively small amounts of money.

Misleading Investment Claims in Advertising

Advertisements often employ tactics that oversimplify or misrepresent investment realities. Critical analysis is needed to avoid falling prey to these deceptive claims.

- “Guaranteed Returns”: No investment guarantees a specific return. Market fluctuations and unforeseen circumstances can always impact investment performance. This claim is deceptive and should be viewed with extreme skepticism.

- “Get Rich Quick” Schemes: Promises of extraordinarily high returns in a short period are often associated with high risk and fraud. Legitimate investments typically involve a longer time horizon for substantial growth.

- Omission of Important Information: Advertisements may highlight potential gains while downplaying or omitting associated risks and fees. Thorough research is necessary to understand the complete picture before investing.

Long-Term vs. Short-Term Investment Strategies

The time horizon significantly impacts the choice of investment strategy and associated risks.

| Investment Strategy | Time Horizon | Risk Level | Potential Returns |

|---|---|---|---|

| Long-Term (e.g., index funds, real estate) | 5+ years | Generally lower (depending on specific investments) | Potentially higher, due to compounding |

| Short-Term (e.g., high-yield savings accounts, money market funds) | Less than 5 years | Generally lower | Lower potential returns, but greater liquidity |

Diversification and Risk Mitigation

Diversification is a crucial risk management strategy. By spreading investments across different asset classes, investors can reduce the impact of losses in any single investment.

- Example 1: A portfolio consisting of stocks, bonds, and real estate reduces the overall risk compared to investing solely in stocks.

- Example 2: Diversification across different sectors (e.g., technology, healthcare, energy) within the stock market mitigates the impact of poor performance in a specific sector.

- Example 3: International diversification, including investments in foreign markets, can reduce exposure to domestic economic downturns.

Analyzing Investment Risks and Rewards

Every investment carries some degree of risk. Understanding the risk-reward profile of different investment options is crucial for making informed decisions aligned with your risk tolerance and financial goals. This section will delve into high-risk investments, compare the risk profiles of various asset classes, and examine the impact of inflation.

High-Risk Investments and Downsides

High-risk investments offer the potential for substantial returns but also carry a significant chance of substantial losses. Understanding these downsides is crucial before considering such options.

- Penny Stocks: These highly speculative investments are often volatile and prone to significant price swings. The risk of losing the entire investment is very high.

- Cryptocurrencies: The value of cryptocurrencies can fluctuate dramatically, influenced by factors such as regulatory changes, market sentiment, and technological advancements. Their price volatility poses a significant risk.

- Options Trading: Options contracts offer leveraged exposure to underlying assets, magnifying both potential profits and losses. Inexperienced traders are particularly vulnerable to significant losses.

Risk Profiles of Stocks, Bonds, and Real Estate

Different asset classes present varying levels of risk and potential returns. Understanding these differences is vital for portfolio construction.

| Investment Type | Risk Level | Potential Return | Liquidity |

|---|---|---|---|

| Stocks | High | High | High (for publicly traded stocks) |

| Bonds | Medium (generally lower than stocks) | Medium (generally lower than stocks) | Medium (depends on the bond type) |

| Real Estate | Medium to High (depending on market conditions and leverage) | Medium to High (depending on market conditions and property appreciation) | Low (can take time to sell) |

Impact of Inflation on Investment Returns

Inflation erodes the purchasing power of money over time. Understanding its impact on investment returns is critical for achieving financial goals.

Scenario: Suppose you invest $10,000 and earn a 5% annual return. However, if inflation is 3%, your real return is only 2% (5% – 3%). Over time, this difference compounds, significantly impacting the real value of your investment.

Factors Influencing Investment Performance, Which of the following statements about investing is false

Numerous factors can influence the performance of a specific investment. Understanding these factors is essential for making informed investment decisions.

- Economic Conditions: Recessions, economic growth, and interest rate changes can significantly impact investment performance across various asset classes.

- Company-Specific Factors (for stocks): A company’s financial health, management quality, and competitive landscape influence its stock price and potential returns.

- Geopolitical Events: Global events such as wars, political instability, and natural disasters can significantly affect market sentiment and investment performance.

Understanding Investment Time Horizons: Which Of The Following Statements About Investing Is False

The investment time horizon—the period for which you plan to invest—significantly impacts your investment strategy and risk tolerance. This section explores the relationship between time horizon and risk, the implications of premature withdrawals, and the importance of financial planning.

Investment Time Horizon and Risk Tolerance

Longer time horizons generally allow for greater risk tolerance, as there’s more time to recover from potential losses. Conversely, shorter time horizons often necessitate a more conservative approach.

Example: A young investor with a 30-year time horizon may comfortably invest a larger portion of their portfolio in stocks, accepting higher risk for potentially higher returns. An investor nearing retirement with a shorter time horizon might prefer a more conservative portfolio with a lower risk profile, prioritizing capital preservation.

Implications of Premature Withdrawals

Withdrawing investments prematurely can lead to significant losses, especially if the market is down. This is due to the potential for missing out on future growth and incurring penalties.

Example: Suppose you invest $5,000 and it grows to $7,000 over five years. If you withdraw before the investment matures, you might miss out on additional growth and potential compound interest. If you withdraw early due to market downturn, you could experience a loss.

Importance of Financial Planning Before Investing

Thorough financial planning is essential before making investment decisions. It helps define financial goals, assess risk tolerance, and create a suitable investment strategy aligned with long-term objectives.

Long-term goals, such as retirement planning or purchasing a home, guide investment choices and the allocation of funds. A well-defined financial plan provides a framework for making informed investment decisions.

Impact of Compounding on Long-Term Investments

Compounding—earning interest on interest—is a powerful tool for long-term wealth building. This section illustrates the growth potential of compounding over time.

| Year | Starting Amount | Interest Rate | Ending Amount |

|---|---|---|---|

| 1 | $1,000 | 5% | $1,050 |

| 2 | $1,050 | 5% | $1,102.50 |

| 3 | $1,102.50 | 5% | $1,157.63 |

| 10 | $1,000 | 5% | $1,628.89 |

| 10 | $1,000 | 10% | $2,593.74 |

Evaluating Investment Opportunities

Before committing funds to any investment, thorough evaluation is critical. This section provides a checklist of key factors, due diligence steps, and a hypothetical investment scenario to illustrate the decision-making process.

Checklist for Investment Decisions

A systematic approach to evaluating investment opportunities minimizes risks and maximizes the chances of success.

- Understand the Investment: Clearly define the investment’s nature, risks, and potential returns.

- Assess Your Risk Tolerance: Align the investment with your personal risk tolerance and financial goals.

- Diversification: Ensure the investment aligns with your overall portfolio diversification strategy.

- Fees and Expenses: Carefully examine all associated fees and expenses, as these can significantly impact returns.

- Time Horizon: Match the investment’s time horizon with your personal financial goals.

Due Diligence Steps

Conducting thorough due diligence is essential to avoid costly mistakes.

- Research the Investment: Independently verify information from multiple reliable sources.

- Seek Professional Advice: Consult with a qualified financial advisor for personalized guidance.

- Review Financial Statements: Analyze financial statements and other relevant documents to assess the investment’s financial health.

Hypothetical Investment Scenario

Consider a choice between investing in a high-growth tech stock and a dividend-paying utility stock. The tech stock offers higher potential returns but also carries greater risk, while the utility stock provides a more stable income stream with lower growth potential. The best choice depends on your individual risk tolerance and investment goals.

Importance of Seeking Professional Financial Advice

Seeking professional financial advice is particularly crucial in complex situations, such as estate planning, retirement planning, or significant investment decisions. A qualified advisor can provide personalized guidance based on your individual circumstances and financial goals.